In general, people are not happy when the market takes a downturn. Finding instruments that work in a down market can be few and far between. The Inverse Performance Trigger is one index allocation that can leverage a negative market.

The Inverse Performance Trigger is calculated by taking the index values from the beginning of the contract year and comparing it to the index values at the end of the contract year.

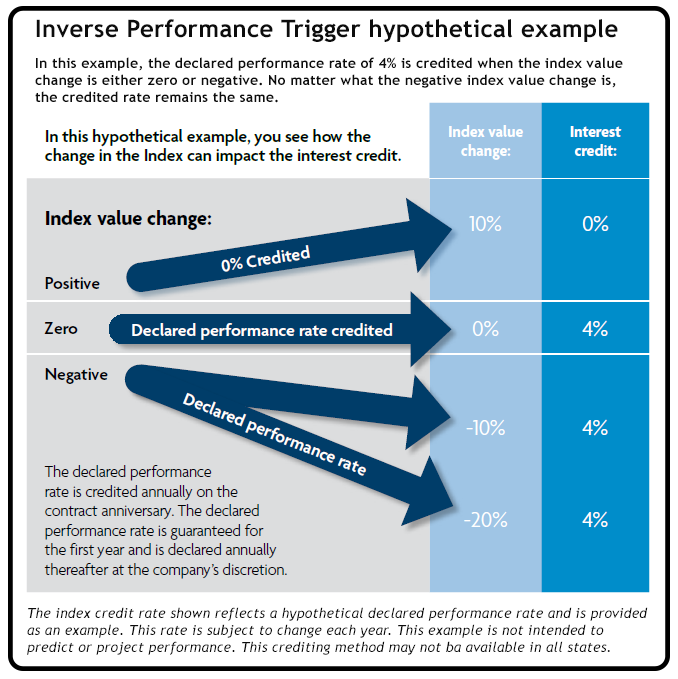

- If the ending index value is equal to or less than the starting index value, the money allocated to this option will be credited interest at the declared performance rate.

- If the ending index value is greater than the beginning index value, the money allocated to the option will receive a 0% interest credit percentage. (reference chart below)

Contrary to other allocations, if the percent of index value change is calculated at a positive percentage, since the allocation is built to specifically leverage a negative market, the funds assigned to this allocation will receive zero return interest credit percentage for that contract year.

Interest credits will only be added to this strategy upon the contract anniversary. Once added, credits will “lock in”, oftentimes referred to as an annual reset or term-based reset. The funds allocated to the Inverse Performance Trigger won’t be affected by possible future positive index performance until the funds are repositioned to an allocation responsive to positive market growth. Moving from one allocation to another generally takes place within a specified period around the contract anniversary date. Regardless of market performance, since the Inverse Performance Trigger crediting method is an allocation offered within some fixed index annuities, interest credits can never be less than zero. This element, interest credits never being less than zero, is built into all fixed index annuities and is oftentimes referred to as downside protection. Optional benefits, such as income riders, can, in some contracts, subtract the cost of the rider(s) from the accumulated value. Regardless of interest growth, interest may not always cover the cost of the rider(s), causing the accumulated value to be less than the prior year.

Information presented in the post is general and for educational purposes only. For specific information pertaining to an individual situation, it is advised to contact a licensed insurance professional. Fixed index annuities are not a direct investment in the stock market. They are long-term insurance products with guarantees backed by the issuing company. They provide the potential for interest to be credited based in part on the performance of specific indices, without the risk of loss of premium due to market downturns or fluctuation. Although fixed index annuities guarantee no loss of premium due to market downturns, deductions from your accumulation value for additional optional benefit riders could under certain scenarios exceed interest credited to the accumulation value, which would result in loss of premium. They may not be appropriate for all clients. Interest credits to a fixed index annuity will not mirror the actual performance of the relevant index.

The Inverse Performance Trigger is just one crediting method (strategy) on some fixed index annuities and this is not intended nor should it be looked at as allocation advice.

Please feel free reach out to me at 508-353-2524 or mark@mcardoza.com with any questions. I would enjoy helping you with your own situation.

DR1273 4/20 - 22