Blog

- Written by Justine Harrington

Whether it’s for yourself or someone you care for, long-term care is an issue that we need to confront. When the time comes, most people will need help paying for care.

This article presents three strategic models and options for paying for the cost of long-term care, whether leveraging a retirement or investment account. Your specific objective will determine which model works best for your situation.

Not everyone needs long-term care insurance, but the majority of us will need care. How your care is paid for is up to you and your financial situation.

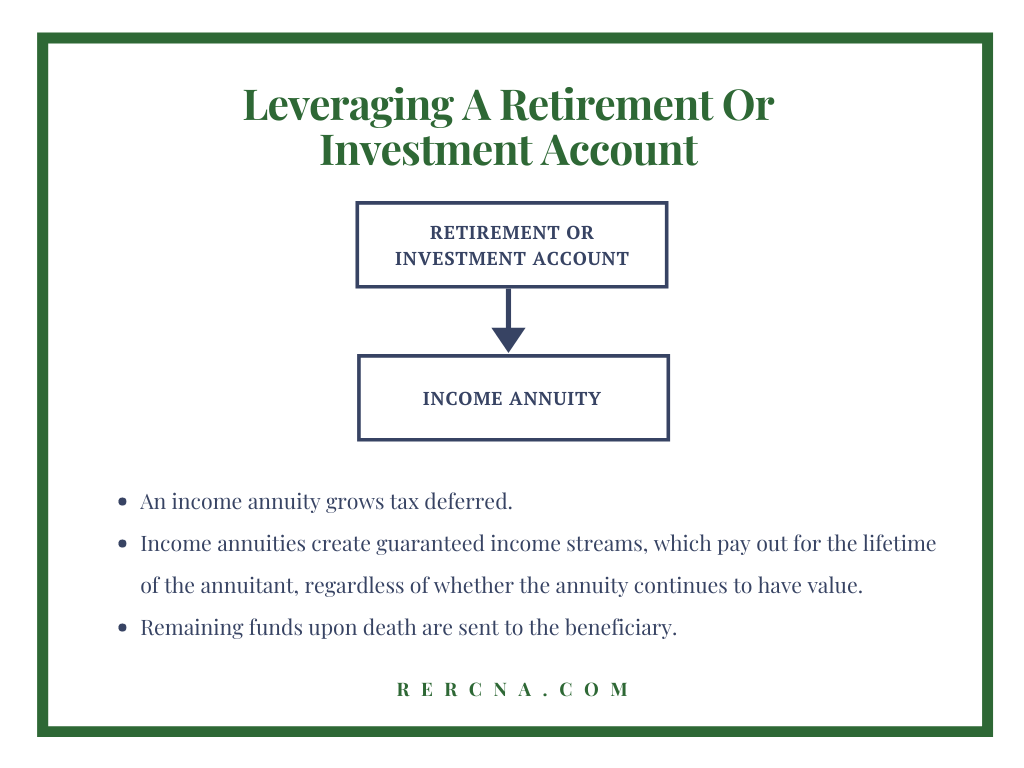

Leveraging a Retirement or Investment Account

Most people need to use their retirement or investment account to pay for long-term care, whether it’s through an insurance policy or directly from their account(s). Leveraging your retirement or investment account to create an income annuity is an effective way to minimize the cost of paying for a long-term care insurance plan.

Using an income annuity is the least expensive way of paying for long-term care insurance.

Each of these three models is designed to accommodate different needs and objectives.

Model 1: Funding a Traditional Long-Term Care Policy

In model 1, an income annuity funds a traditional long-term care insurance policy. Generally, once a traditional long-term care policy is in claim and the elimination period is satisfied, the premium is no longer required; however, the annuity continues to pay out. This model leverages a portion of a retirement or investment account and returns nothing to the beneficiary or estate.

Model 2: Asset-Based Funding

In model 2, an income annuity funds a traditional long-term care insurance policy. Once the long-term care policy is in the claim process and the elimination period is satisfied, the LTCI premium is no longer required; however, the annuity continues to pay out. Upon the insured’s death, the life insurance policy proceeds will reimburse the beneficiary/estate for the money used to fund the annuity.

Model 3: Hybrid Asset-Based Life Insurance with LTC Rider

In model 3, an income annuity funds a traditional long-term care insurance policy. The life insurance policy has a qualified LTC rider attached that mirrors the face value. If you are receiving care at home, going to day care, or living in an assisted living or a skilled nursing facility, the LTC rider will provide a source of funds up to your monthly allowance until the policy is exhausted. Funds that are not utilized for long-term care are distributed as a death benefit and paid to the beneficiary or estate.

Our help line is there for you.

For assistance to determine the model that best fits your situation, please feel free to reach out to one of our certified long-term care specialists to discuss your situation.

Phone: 617.982.3692

Email: info@rercna.com

Attend a webinar: visit rercna.com to view the schedule and register.

- Written by Justine Harrington

Imagine never running out of money— Having a monthly income that provides for all your expenses including food, entertainment, and gifts for the rest of your life and your spouse’s life. Imagine having funds beyond your income that can be dedicated to having fun and enjoying retirement. Imagine waking up to find out a world tragedy has struck and the foreign markets have crashed. Others are watching their funds plummet and scrambling to contact their advisors while you sit secure. You have a guaranteed income supporting your everyday lifestyle and no reason to worry about the financial markets to pay your bills.

That’s what our upcoming blog series is about—satisfying your everyday obligations so you can sit back, relax, and enjoy your retirement.

It would be much easier to prepare for retirement if we understood the distribution phase.

As we get closer to retirement, we begin to imagine what our lives will be like. How we will pay our bills and how much money will we have to spend on vacations and hobbies are generally considered. Most of us have been contributing to a retirement plan through an employer and/or independently. Many of us have multiple homes and have developed hobbies we would like to carry with us into retirement. After all, isn’t that what retirement is all about, doing what we want and enjoying what we have accumulated?

You begin to review your retirement programs, pensions, Social Security, investments, personal savings, and so on. Your advisor who has helped you get where you are projects your funds to carry you into your 90s. Your financial concerns are health insurance and Medicare, not running out of money, Social Security, assistance while aging, estate planning, and taxes.

Over the next week we will release a blog series linked below covering 5 Steps to Income Planning:

- Annualizing Expenses and Considering Inflation

- Organizing Incomes—Social Security, Pension, Etc.

- Calculating Income Shortfall or Surplus

- Establishing Lifetime Income Streams

- Finding a Qualified Professional to Create Income Streams 4 Life

These 5 tips to income planning should help you think through the process of organizing yourself for the distribution phase, known as retirement. For 35 years or so, you have focused on accumulating and growing your funds. Now, utilizing the funds to provide the necessary services to last a lifetime is the issue. Leaving a legacy to children may also be desired, but it can conflict with avoiding the uncertainty of running out of money and preparing for the potential challenges life throws at you as you grow older. No one can tell you exactly how to accomplish what you are trying to do. The subject is often left ambiguous and open ended.

The intent of this series is to help answer some of the questions you have and provide suggestions, ideas, and direction, leaving you with less ambiguity.